An interest-free financial system is a contracted definition of Islamic banking that reflects the ideology of Islamic Shariah which Islamic banking is based on. Criteria Islamic Home Financing Conventional Home Financing Base Rate The banks ceiling profit rate is based on the Islamic Base Financing Rate.

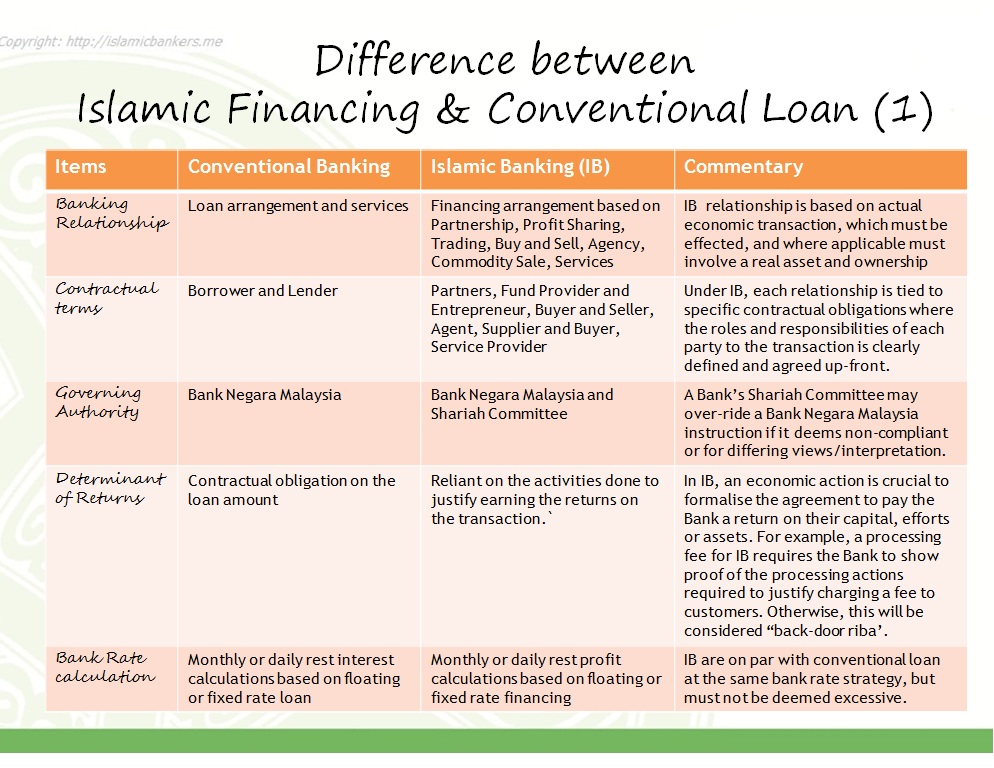

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

8 Aug 2018 - Wed 1 day 300pm - 500pm Selangor Bar Committee Auditorium No37 39 41 Jalan Bola Jaring 1315 Section 13 Shah Alam 40100 Selangor.

. Similarities and Differences between Islamic and Conventional Banking Financing and Investments The savings mobilization process is to extend credit to businesses and industries in exchange for a return. A General Investment Account follows the laws and principles of Shariah as set by the Quran whereas the. Conventional Banking vs Islamic Banking.

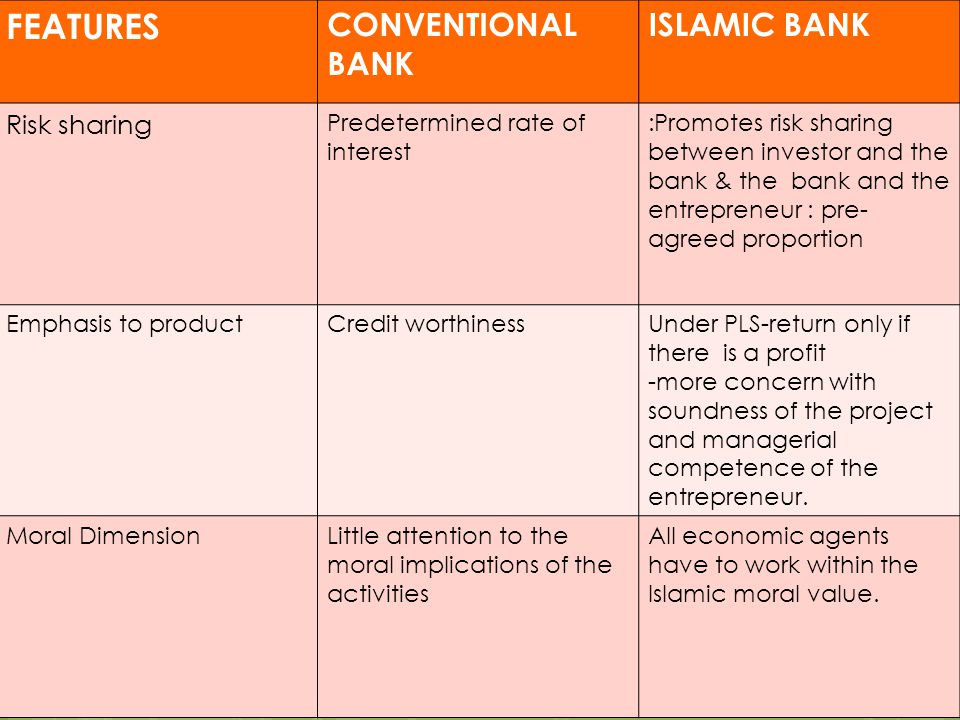

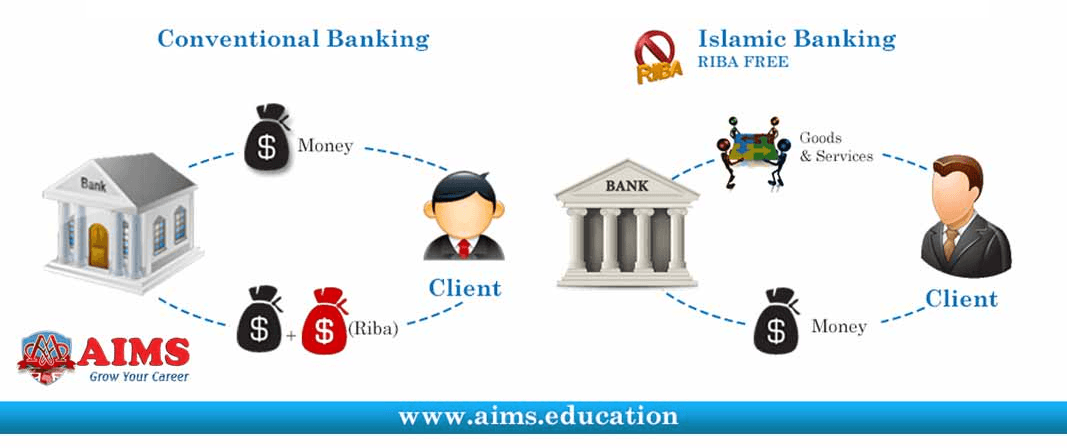

Effectively it can be defined as a banking system that adheres to the high ethos and moral values of Islam that is governed by the principles laid down by Islamic Shariah standards. So you can easily understand the which ione is best for you. Conventional Banks use money as a commodity which leads to inflation.

ABMF3213 - Islamic Banking. This assignment briefly explains the differences between Islamic banking and conventional banking. The difference between Islamic banking and conventional banking is not major but it can actually work out more in favour of Islamic finance in Malaysia.

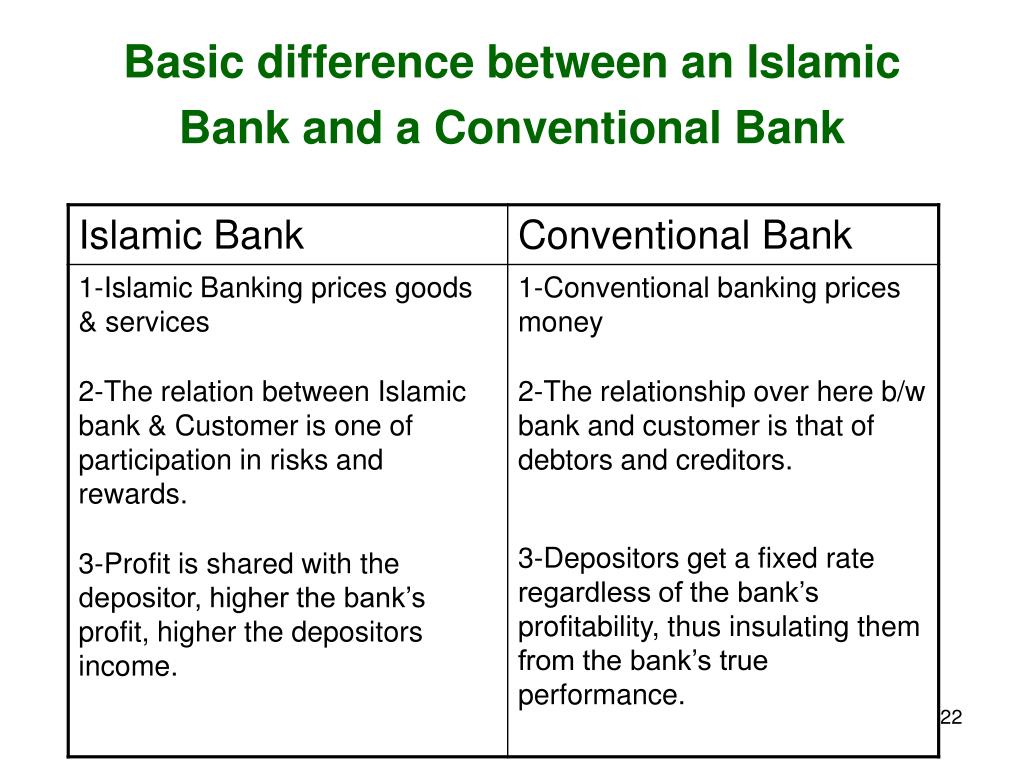

A Clear Picture of islamic Conventional Banking in an easy way. Since the money is linked with the real assets therefore it contributes directly in the economic development. Islamic Banks earn profits by exchanging goods and services.

In Islamic Banking the equivalent of the FD is known as the General Investment Account. Tunku Abdul Rahman University College. Time Value- Conventional banks earn their profits based on the time taken to repay the loan.

The distinction is in the funding agreement. The country like in Malaysia has successfully developed an Islamic banking system that operates in parallel with the conventional banking system. Conventional Bank treats money as a commodity and lend it against interest as its compensation.

In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance. Relationship of customer bank is of Seller- Buyer and. This talk will discuss introduction to conventional banking introduction to Islamic banking mechanics of conventional and Islamic banking.

Documents similar to Differences between Islamic banking and conventional banking are suggested based on similar topic fingerprints from a variety of other. For that very reason a conventional bank is allowed to maximize profits without any general restriction. Islamic Banking tends to link with the real sectors of the economic system by using trade related activities.

There is similarity. Ability of the Islamic banking in Malaysia to be an alternative or substitute for the commercial bank during the financial crisis. Conventional Banking In most Islamic countries they tend to practice two types of financing in banking industry which are conventional and Islamic banking.

This is the first in a series of articles on Islamic finance and banking concepts. Relation of customer bank is of Creditor-Debtor. An introduction to general Islamic banking principles and structures.

Bank Islam Malaysia Berhad BIMB was the first Islamic bank in Malaysia having been set up on 1 July 1983. Interest- Conventional banks ensure to charge interest even if the organization is at a downfall. In addition this paper also examine the stability of Islamic bank compared to commercial banks that in which at the end focusing on the target towards the achievement of sustaining in the real economic growth and.

Based on the Malaysian Islamic Banking Act 1983 Islamic banking is a comprehensive and value-based system that aims to respect and enhance the moral and material wellbeing of individuals and society in general Yahya et al 2012. Unlike Conventional Banks an Islamic Bank acts as an intermediary between the depositor and the entrepreneur. Both sorts of institutions which is Islamic and Conventional finance productive channels in exchange for a return.

Islamic banking products are usually asset backed and involves trading of assets renting of asset and participation on profit loss basis.

Differences Of Components In Balance Sheet Of Islamic And Conventional Download Table

A Comparison Between Malaysia And Indonesia In Islamic Banking Industry Semantic Scholar

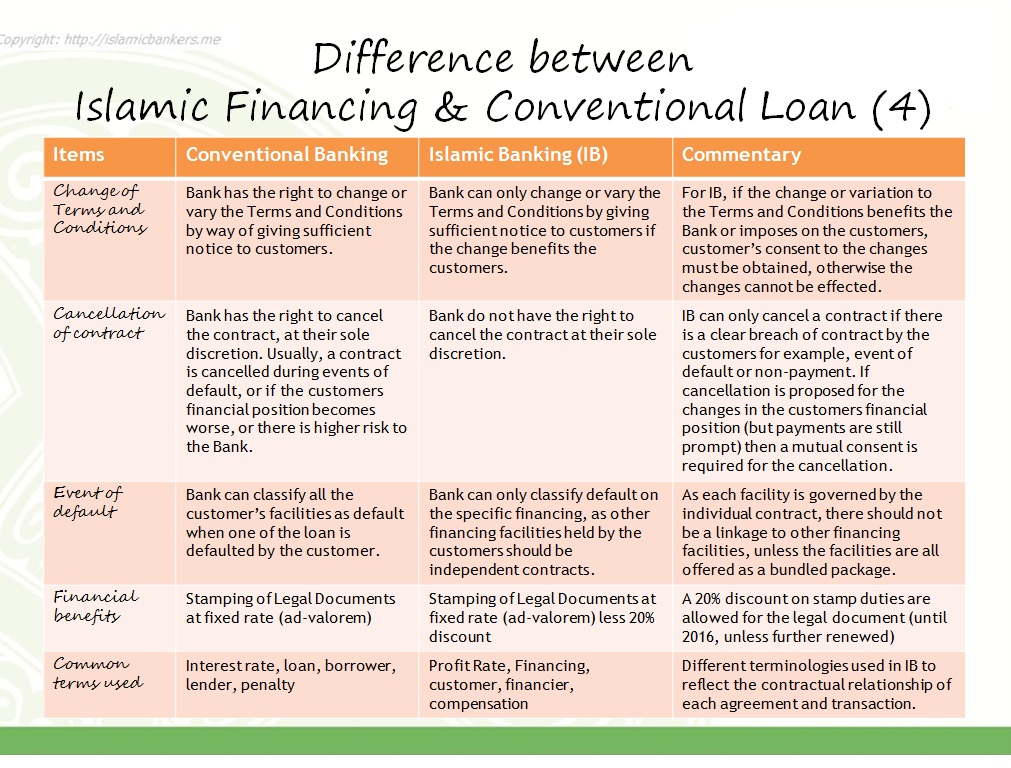

Difference In Islamic Banking Islamic Bankers Resource Centre

Pdf Comparative Analysis Of Conventional And Islamic Banking Importance Of Market Regulation Semantic Scholar

Difference Between Islamic Banking And Commercial Banking Features

Pdf The Financial Performance Of Islamic Vs Conventional Banks An Empirical Study On The Gcc Mena Region Semantic Scholar

Conventional Banking Islamic Bankers Resource Centre

Pdf A Comparison Between Islamic Banking And Conventional Banking Sector In Pakistan Semantic Scholar

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

Conventional And Islamic Banks Financial Contracts Download Scientific Diagram

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

Risk Profile Of Conventional Vs Islamic Banks Download Table

Islamic Subsidiary Islamic Bankers Resource Centre

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Ppt Islamic Banking Historical Growth Future Outlook Powerpoint Presentation Id 5197987

Islamic Banking Vs Conventional Banking Aims Uk